|

||

|

|

||

|

||

|

PLEASE READ - all of these cases come from where you live |

||

|

Good Evening Resident

If you find this information helpful, please “rate” this message at the bottom (very quick and simple). Please help us to reach more residents. Tell your neighbours, friends & family about Hampshire Alert - anyone can register - https://www.hampshirealert.co.uk/

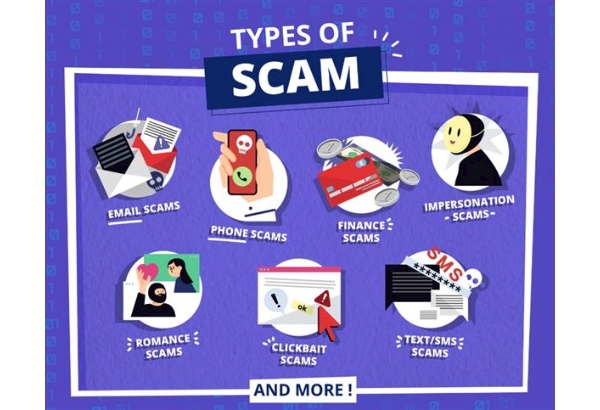

FRAUD / SCAMS – do you know this is happening nearly every day around where you live? ALL of these 14 cases have happened in the last few months IN OUR AREAS – and there A LOT MORE. Scammers do usually target older people, but ANYONE can be a victim.

PLEASE SPEAK TO YOUR FRIENDS AND FAMILY and have a conversation about these cases - who are they speaking to on the phone and online, are they being targeted too?

If contact was made by a scammer through your phone number or email address, it needs to be a top priority for you to change these ASAP – as you will almost certainly be targeted again through these.

PLEASE SEE THE ADDITIONAL SAFEGUARDING INFORMATION ATTACHED.

1 Lady in her 80’s, Loss £7000 – Victim called on landline by ‘Police’ who said they had a man in custody and they were running a multiple million pound investigation into the man and others who worked at the bank. Detective asked if she was willing to help the investigation and if so she would need to “take an oath” and must not tell anyone about their investigation and they needed her to withdraw some money. A ‘Superintendent’ then spoke to her and asked her to withdraw £7000 from her bank, so it could be tested for counterfeit notes and fingerprints. She was told to keep her phone on throughout and give the bank a cover story, to say that the money was a belated Christmas gift for grandchildren. Victim returned home and was rang again and told the money would be collected from the home and a password was set up. Shortly later a young man knocked the door gave the password and collected the money.

2 Young man in his teens, Loss £65 – Victim was contacted by someone sending him 3 photos of a woman, 2 of which were her naked. The person said the victim needed to send them photos of himself or they would tell his friends he had received photographs of a naked woman. The victim felt pressured and sent back 3 photographs of himself, 1 of which was an intimate photo. The victim then received a call and was told he needed to send the person £400, or he would post the photographs to the victims TikTok friend list, which he had. Victim did not have £400, but had £65 which he put onto an Apple gift card and sent, this was quickly redeemed. The man asked for more money and told the victim he needed to check in when he wakes and when he goes to bed.

3 Lady in her 90’s, Loss £2000 – Victim was called by a man from the ‘bank fraud unit’, and told her bank details had been compromised. She was told to withdraw £2000 from her bank account, and post this to an address in London.

4 Man in his 30’s, Loss £455 – refunded – Victim saw an advert on Tiktok for earning money, set up bitcoin account, basically playing with money that’s not yours, 10% increase, each time, daily liking of TikTok videos, increase money, become an employee – moving up levels, 3 levels. Victim was a previous victim of a scam where he was added on snapchat, spoke on telegram, woman asked can you lend me £20 on a gift card, online purchase eneba.com buy digital gamer key and sent screen shot on telegram, kept asking for another £20, said she’d send back £1000, stopped after sending £40.

5 Couple in their 80’s, Loss - £1155 – Cold called to landline about doing an energy advice survey by ‘Green Home Energy Innovations’. Couple paid a deposit of £1155 on a home visit by a rep. Company now not answering contact and no one came to do any work.

6 Couple in their 80’s, £215 – refunded – Victim was looking to invest into cryptocurrency and saw a video advert with Martin Lewis talking about an investment opportunity, thought it must be genuine as Martin Lewis was talking about it. Victim made contact and gave name, contact details, age, monthly income and savings amount and paid £215 via payment card. The caller realised this was fraud when the caller found an article in the news warning about the fraud.

7 Lady in her 70’s, Loss - £14,000 – Victim was originally told by a friend about an investment opportunity in ‘Fidelity Investments’ costing £200. Victim called the company and was happy to risk £200 for the potential of the making good money using an algorithm. £200 grew to £29,000 over a few months. Then a complex situation arose for the victim to ‘get’ the money, involving needing to use her own money to open multiple accounts and transfer a total of £14,000, all the while she thought she would get her original money back, plus the investment money. Victim re targeted a few weeks later, by someone saying that her £31,000 had been moved to them and she needed to open a Xapo account but needed £6,000 for escrow and then she would get £37,512 within 3 hours.

8 Man in his 80’s, Loss £37,742, refunded by the bank. A close family member noticed some unusual transactions on the male’s bank statements while looking after his home and affairs, (while the victim was in hospital). Someone had gained access to his bank account and passwords and had been taking money from his account to the total of £37,742. The bank began an investigation into this loss. It was thought that someone had obtained his bank details and was impersonating him to obtain the money.

9 Man in his 20’s, no loss despite demands made - Victim met a stranger online and began chatting over a short period of time, resulting in him sending the person an intimate photograph. The person then regularly demanded money, saying they would send the photo to family and friends.

10 Man in his 60’s, Loss £267,000 - The victim was recommended a company to invest money in via a friend. He invested over £260,000 over time but when he checked, he found the company had gone into liquidation and the company was bogus.

11 Man in his 30’s, Loss £250 - The victim found out someone had used his identity when parking companies and solicitors / debt collectors started contacting him for unpaid tickets and debt avoidance. These tickets / debts were unrelated to any cars that he owned. The victim has been made to feel in fear that he will receive more fines, more debt letters, more impending threats of CCJs and he has had a Bailiffs letter and this has caused him much stress and worry. Victim has paid a £250 fine to avoid a CCJ.

12 Lady (widowed) in her 80’s, Loss approx. £2600 - Victim was contacted and ‘friended’ via Facebook by a man who said he was ex-military working on an oil-rig, trying to get home to his daughter in America. ‘John’ sent her texts at least 3 per day, told her she looked very young for her age. The texts said his age was 60 something. After a 2/3 months of texts that became romantic, he started asking for money via PayPal and e-gift cards. She hid this ‘romance’ from her family. She said she thought it was too good to be true, but she felt really lonely and said it was worth paying the money to be told she was loved. She feels heartbroken and is feels she is grieving the end of a real relationship, even though they never met or even had one telephone call.

13 Vulnerable family, Loss £450 - Carers report a man came to the house and said a family member had asked him to come around to carry out work on the garden. The man quoted £200, but this grew to £450, cash was given to the man who said he would return with his tools and did not come back.

14 Lady in her 70’s, Loss over £10,000 - Victim was originally called by her ‘bank’s fraud team’ saying there was suspicious activity on her card. She was asked to set up accounts on Taptap and Revolut, and transfer money into them, which the team would the track to conduct the ‘investigation’. She was also asked to put £1000 and 2700 euros in envelopes which a taxi collected. Victim’s card was blocked by her bank due to their concerns over international transactions via Taptap and Revolut. Victim was told what to say to the bank.

Hampshire Alerts is not a crime reporting portal – please do not report crime here. If you realise you’ve been scammed and wish to report a fraud that has already happened, please report it to Report Fraud either by phone 0300 123 2040 or online at: https://www.reportfraud.police.uk/ However, if a fraud or other crime is in progress, and/or you are in fear for yourself or someone else, and/or there is evidence in situ that could be damaged/destroyed, please phone 999 immediately. Otherwise, report non-fraud crime online, or find out about other ways to report a crime at: https://www.hampshire.police.uk/ro/report/ocr/af/how-to-report-a-crime/ If you would like to report a crime anonymously please contact: https://crimestoppers-uk.org/ or phone 0800 555 111 If you've been affected by a crime please contact Victim Care Hub for free, confidential, support: https://www.hampshireiowvictimcare.co.uk/ or phone 0808 178 1641 If you’ve received a phishing email please report it to your email provider and/or forward it to report@phishing.gov.uk If you’ve received unwanted phone calls or texts from people you think are trying to scam you, but you haven’t engaged with them, please forward the text/phone number to 7726 or your phone provider.

Hedge End Neighbourhood Policing Team. PCSO Mica Woodcock 12948 - West End PCSO.

| ||

Attachments | ||

Reply to this message | ||

|

|